Introduction

The AI Testing approach developed by Exactpro is applicable to core banking, FX, trading, fund management, securities clearing and settlement, collateral management, market surveillance and other large-scale financial systems and mission-critical infrastructures. This case study focuses on Exactpro’s AI-enabled software testing capabilities to support the transition of banking and payment systems (including CBPR+) to ISO 20022.

With the MT format now officially a ‘legacy’ format and the period of free MT/MX coexistence elapsed, the banks and banking organisations that have not yet implemented the migration need to speed up their ISO 20022 adoption efforts. Market infrastructures across the globe will be expected to follow suit in the years to come.

As of September 2025, approximately 60.2% of the payment instructions traffic on the SWIFT network had transitioned from FIN to native ISO 20022, reflecting a substantial increase from the 41.2% recorded in May 2025. While adoption has accelerated significantly in the final phase of free coexistence, this progress also highlights the scale and complexity of the remaining migration efforts still required across the industry.

An ISO 20022 migration is not a trivial technology task. However, its speed can be streamlined and quality enhanced with thorough testing. Performing specialised testing of a core banking system for ISO 20022 compatibility helps ensure seamless payment processing and interoperability, thus, helping demonstrate full regulatory compliance and achieve a high level of operational resilience. At Exactpro, we have years of experience testing and helping integrate ISO 20022-based financial infrastructures.

Exactpro’s AI Testing approach can be used to drive software development of a new system, facilitate technology acceptance assessment during system migrations from legacy to newer platforms, as well as enhance the quality assessment framework in an existing infrastructure. Exactpro teams can conduct an in-depth exploration of an existing ISO 20022-related testing practice by assessing the current test strategy, test library and the surrounding processes and providing actionable insights on potential enhancements and efficiencies that can be introduced in your organisation, including those driven by AI Testing.

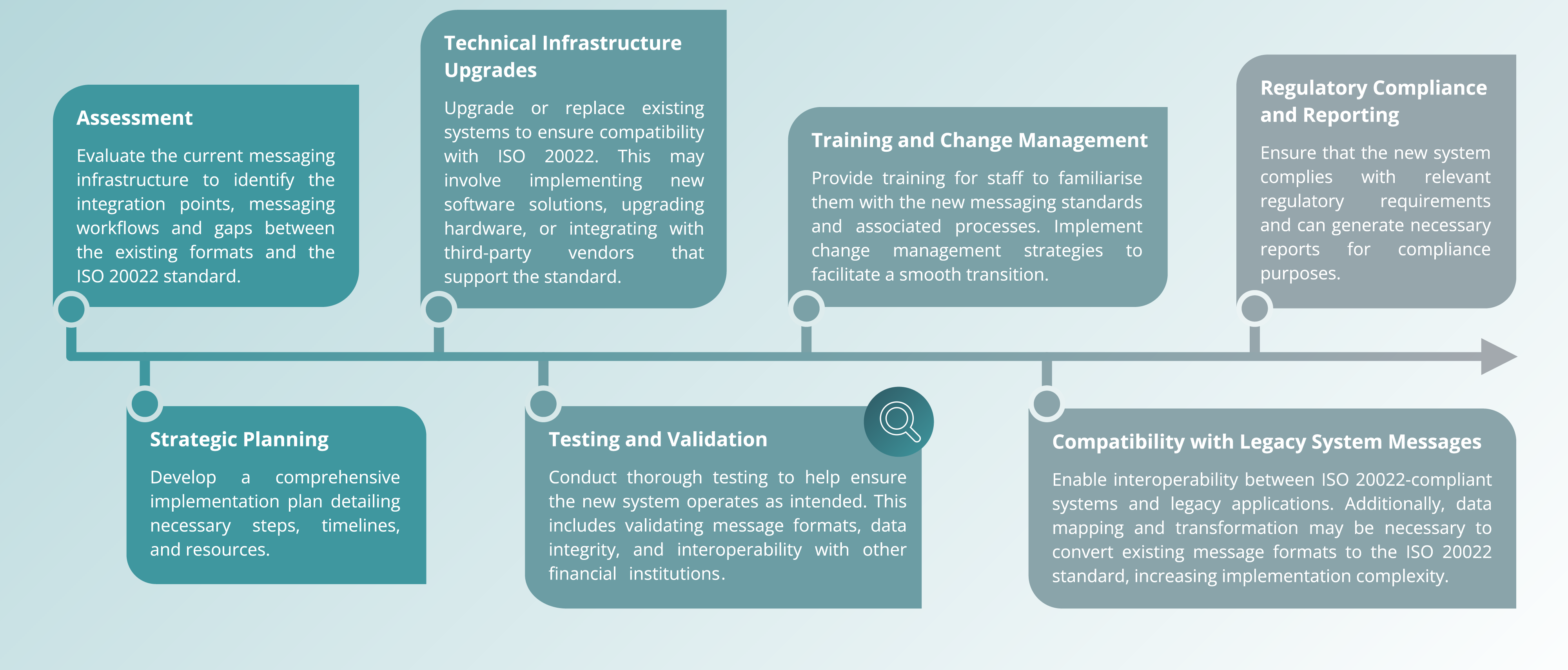

The ISO 20022 Implementation Roadmap shown below (see Fig 1) is a high-level outline of the main steps involved in a migration.

Fig 1. ISO 20022 Implementation Roadmap

What stage of the migration are you at?

Get in touch with us to find out how Exactpro expertise and the AI Testing approach can help streamline your transition.

Key Components of ISO 20022 Testing in Core Banking

An effective ISO 20022 migration in core banking systems requires comprehensive testing across multiple components and processes. The following table outlines the key areas and system aspects subject to validation and their specifics:

| Testing area | Focus |

|---|---|

| Message Validation & Compliance with ISO 20022 |

|

| Payment Processing & Transaction Flows |

|

| Regression Testing |

|

| API & Integration Testing |

|

| Infrastructure Upgrade Testing |

|

| Performance & Load Testing |

|

| Regulatory Compliance |

|

AI Testing Approach for an ISO 20022 Migration

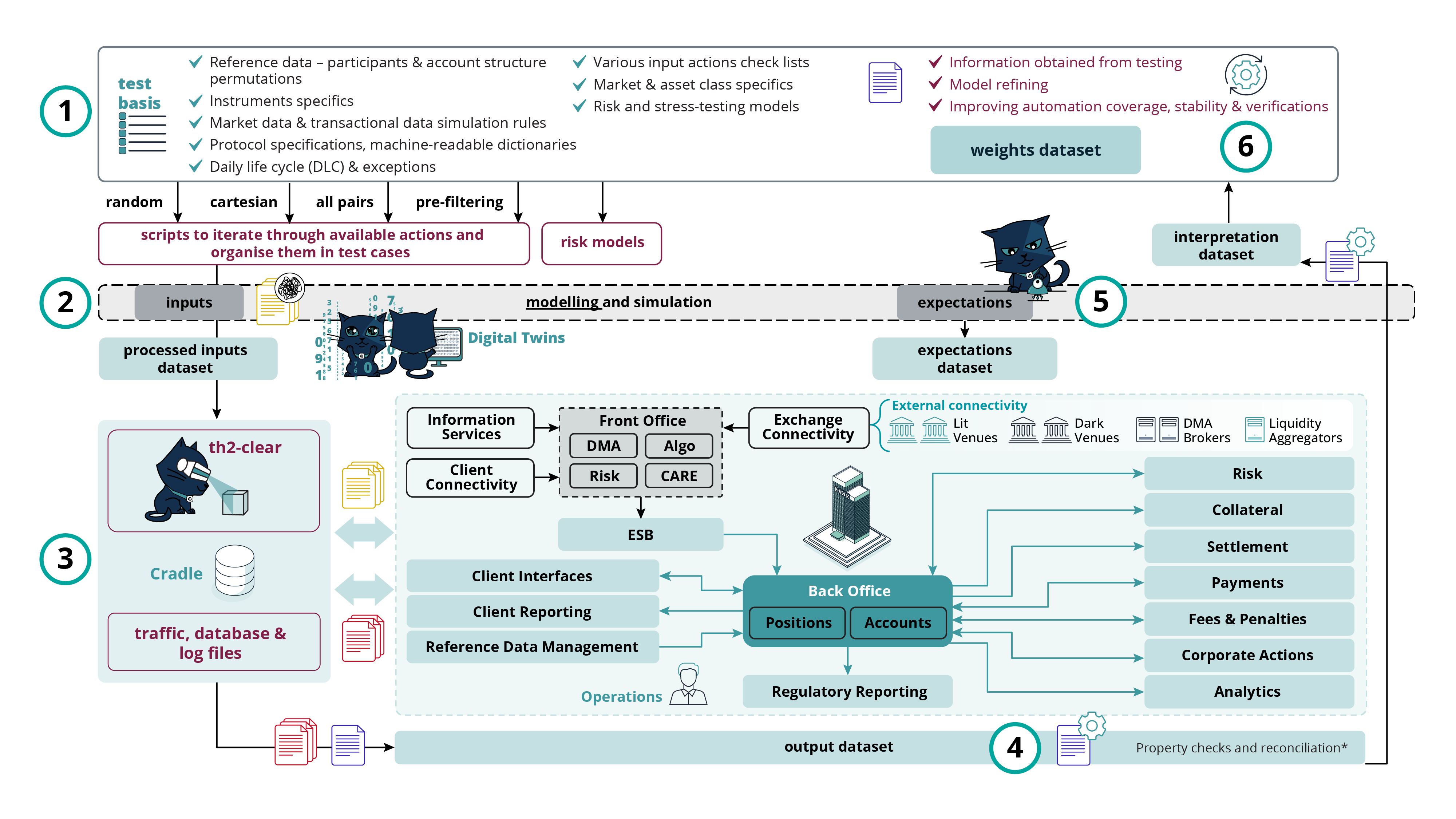

Beyond contributing to bringing down product risks, the AI Testing approach helps clients reduce time to market, maintain regulatory compliance, strengthen scalability, latency and operational resiliency. To see AI Testing in action, please refer to an investment banking system example below (Fig 2). It breaks down the approach into a series of simplified steps:

Fig 2. AI Testing in investment banking schema

In two episodes of our Payments Explained video series (see below), we bring this case study to life and share the exact steps involved in applying our AI Testing approach to ISO 20022 migrations.

AI Testing for an ISO 20022 Adoption | Videos

The Implementation Roadmap & Test Strategy (Part 1) video gives a better understanding of the exact test activities involved, including outlining the multi-layer testing framework.

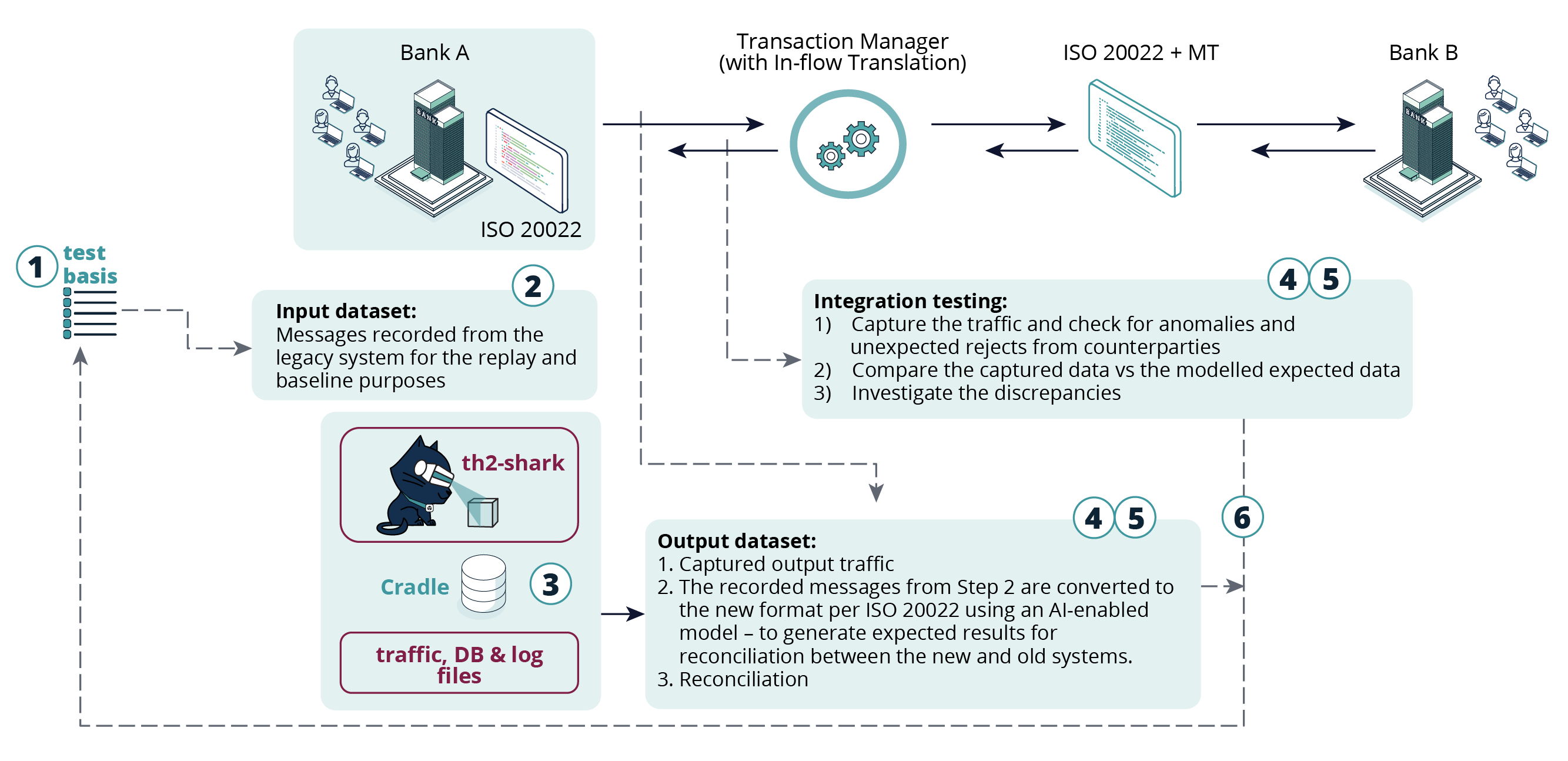

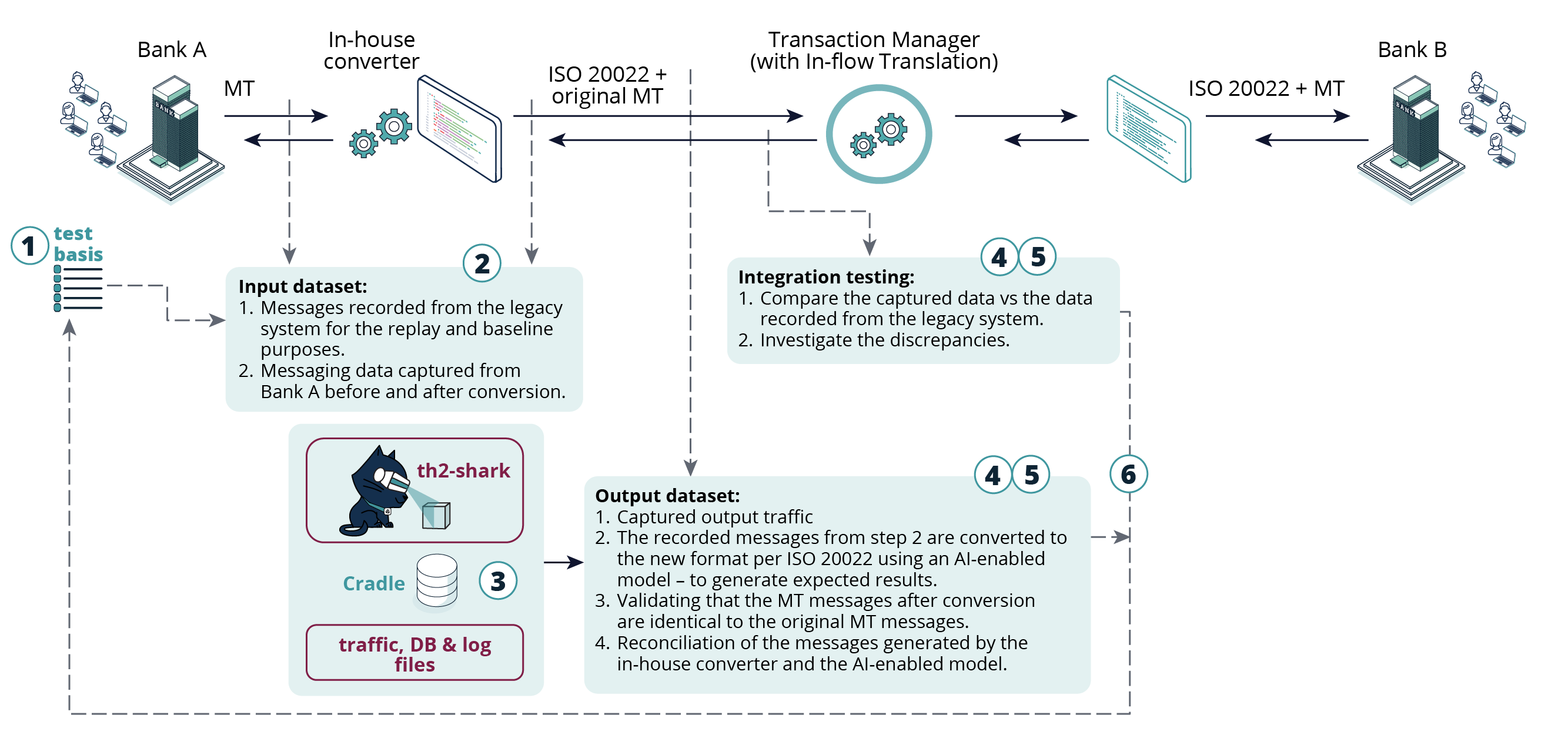

The Test Framework (Part 2) video models two integration use cases and defines the corresponding testing flows (see Fig 3. and Fig 4. below):

- Integration use case #1: Bank A has migrated to ISO 20022 and requires validation of the transition and its MT→MX conversion capabilities for external compliance or an independent technology assessment.

- Integration use case #2: Bank A has not migrated to ISO20022, but in order to support the transaction flow, has built an in-house MT→MX→MT converter. It requires validation of the transition and its MT→MX and MX→MT conversion capabilities for an independent technology assessment or external compliance.

Fig 3. Integration use case #1: Validating an ISO 20022 Transition in a Core Banking System by Applying AI-enabled Modelling and Testing

Fig 4. Integration use case #2: Validating Integration of an In-house ISO 20022 Converter with a Legacy Core Banking System by Applying AI-enabled Modelling and Testing

Conclusion

When applied to testing a core banking system for ISO 20022 compatibility, Exactpro’s AI Testing approach helps ensure seamless payment processing and message interoperability, enabling clients to achieve a high level of operational resilience and demonstrate regulatory compliance.

Our AI-driven testing has a proven track record of strengthening in-house system validation and supporting organisations in adopting ISO 20022 for faster, more secure and globally standardised cross-border payments.

For more insights on ISO 20022 and other key payments topics, you can explore our full video playlist on YouTube.

Get in touch if you are interested in a brief introduction to AI testing and a more detailed ISO 20022 migration roadmap.