Introduction

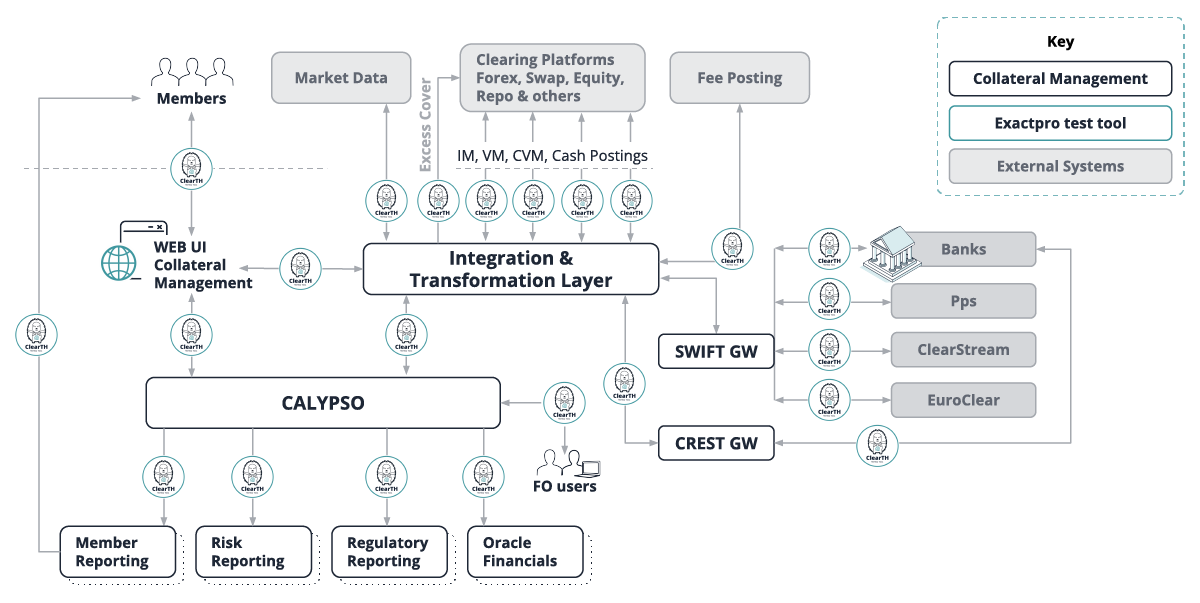

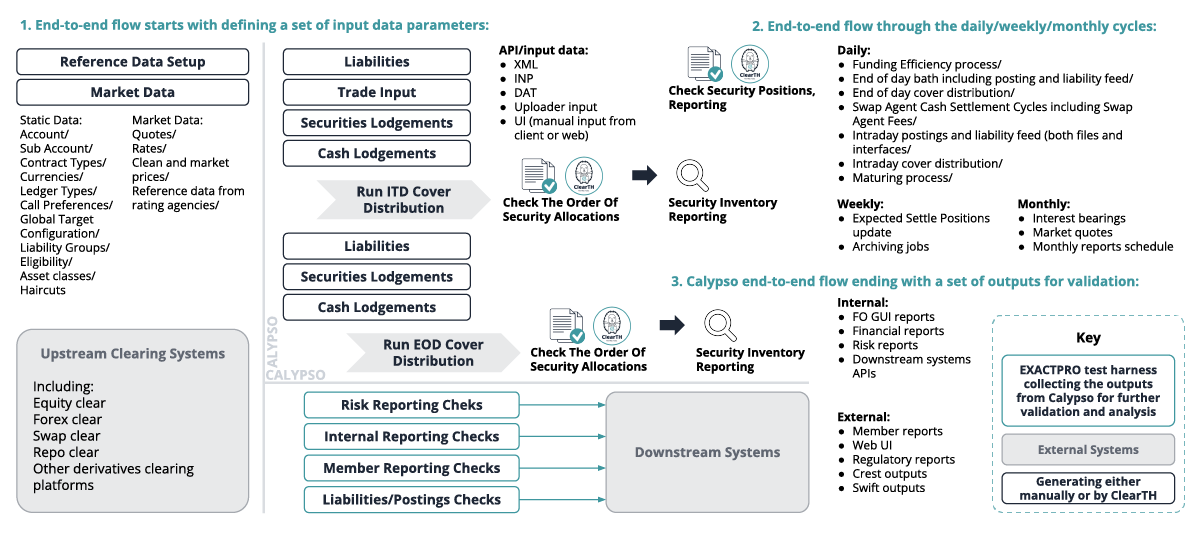

These case studies describe functional and non-functional testing of a collateral and liquidity management system for a leading global rates and multi-asset clearing house and a multi-national central counterparty.

Case Study 1: Testing Collateral and Liquidity Management for a Global Clearing House

Challenges:

- To identify the impact across all available reports & outputs from Calypso;

- To identify the expected result — several reports based on multiple days’ market data;

- To secure proper coverage with a set of input data (for instance, account structure, its roles, collateral types, cover preferences, markets, products, rates, place of custody) which allows emulating all required combinations and cases;

- To simulate a cover distribution model keeping in mind the coverage matrix above in order to derive the expected behavior and outputs for actual results reconciliation.

Case Study 2: An End-to-End Scenario for Collateral Fee Charge to Verify that Clearing House Charges Set for Custodians are Accurate

Case Study 3: An End-to-End Scenario for Cash Withdrawal Flow

End-to-End business flow steps covering emulation and validation of the flow:

- Cash Withdrawal instruction via Web UI;

- Cash Withdrawal authorization via Web UI;

- Calypso side: validation of related Margin Call, Transfers and Messages and relevant limit breaks on the task station;

- Verifying generated MT202;

- Emulating ACK message;

- Checking that transfers are settled and Instruction completion message appears in Web UI;

- Emulating MT950.