Introduction

Members Exchange (MEMX) is a US exchange operator founded in 2019 by the largest U.S. online retail broker-dealers, global banks, financial services firms, and market makers to benefit all investors. MEMX was established to bring new competition into the market to drive three effects: lower fees, provide its members a voice in market dialogue and decisions, and foster innovation.

MEMX Platform Requirements

From the start, MEMX committed to building an exchange that allowed for continuous enhancement and improvement. MEMX’s goal is to use innovation to break free from the past, whilst maintaining system quality, reliability and customer trust to operate a thriving exchange. Below is a review of MEMX exchange functionalities available today.

MEMX provides its members with a set of connectivity options based on common methods and semantics to type, define, encode and decode message data using the FIX Protocol Standard and Simple Binary Encoding (SBE). The table below outlines the interfaces exposed to the members:

|

MEMX-TCP |

A Session Level TCP-based transport protocol for reliable delivery of business messages. |

|

MEMX-UDP |

A Session Level UDP-based transport protocol for best-effort delivery of business messages. |

|

MEMO SBE |

The native binary protocol used for order submission. |

|

MEMO FIX |

The Classic FIX (ASCII Tag/Value) protocol used for the exchange of information related to securities transactions. |

|

MEMOIR Depth |

A real-time full depth-of-book feed offered directly from MEMX. |

|

MEMOIR Top |

A real-time top-of-book feed offered directly from MEMX that provides the best bid and best offer on the exchange. |

|

MEMOIR Last Sale |

A real-time trade feed offered directly from MEMX that provides reporting, cancelation and correction of exchange executions. |

|

Drop Copy |

A Drop Copy in Classic FIX protocol providing information related to trades executed on MEMX with the option to include order related information. |

MEMX supports Pre-Market, Market and Post-Market trading sessions. Both the SBE and FIX MEMO order entry protocols contain an integrated pre-trade risk management service, which includes a mandatory set of configurable controls. They are designed to protect investors and ensure market integrity by preventing erroneous orders from passing through to the matching engine for execution. Additionally, MEMX offers a configurable batch cancel function allowing participants to cancel all or a subset of orders in one or more symbols with a single command to the exchange over any active session, irrespective of the session(s) over which the original order(s) was submitted. MEMX also supports cancel on disconnect.

Based on industry feedback to reduce complexity and promote fair, transparent, and efficient client interactions, MEMX accepts three order types:

- Market (for time-sensitive traders),

- Limit (for price-sensitive traders), and

- Pegged (including Midpoint Peg and Primary Peg orders that will automatically adjust with changes in the National Best Bid and Offer for traders sensitive to periods of market volatility).

MEMX supports a set of modifiers, including:

- Intermarket Sweep Orders,

- Reserve Quantity (with multiple replenishment options including randomized size and time),

- Non-Displayed,

- Minimum Quantity,

- Post Only,

- Book Only, and

- Re-Pricing to comply with Reg NMS, Reg SHO, and Limit-Up/Limit-Down

In addition, several Time-In-Force (TIF) instructions are available to allow participants to select the period of time during which an order is available for execution:

- Immediate-or-Cancel,

- Fill-or-Kill,

- Day,

- Regular Hours Only, and

- Good ‘Til Time.

MEMX routes orders to away markets displaying protected quotations to comply with Reg NMS. A combination of exchange proprietary data feeds and CQS/UQDF data feeds from the Securities Information Processors (SIPs) are used for the handling, execution, and routing of orders.

MEMX required a test solution to properly cover all these areas to ensure proper behavior and function.

The Implemented Solution

To achieve the objective and facilitate the delivery of the exchange, MEMX’s testing team was enhanced with the assistance of the established professional testing services provider – Exactpro – known for its long-term partnerships with some of the leading global exchange groups and a thorough test approach leveraging a bespoke automation test tool suite.

Processes: the MEMX-Exactpro Operating Model

Being a customer-centric market operator, MEMX engaged Exactpro at the early stages of the program for review of the client-facing specifications in order to deliver clear and transparent documentation to the participants.

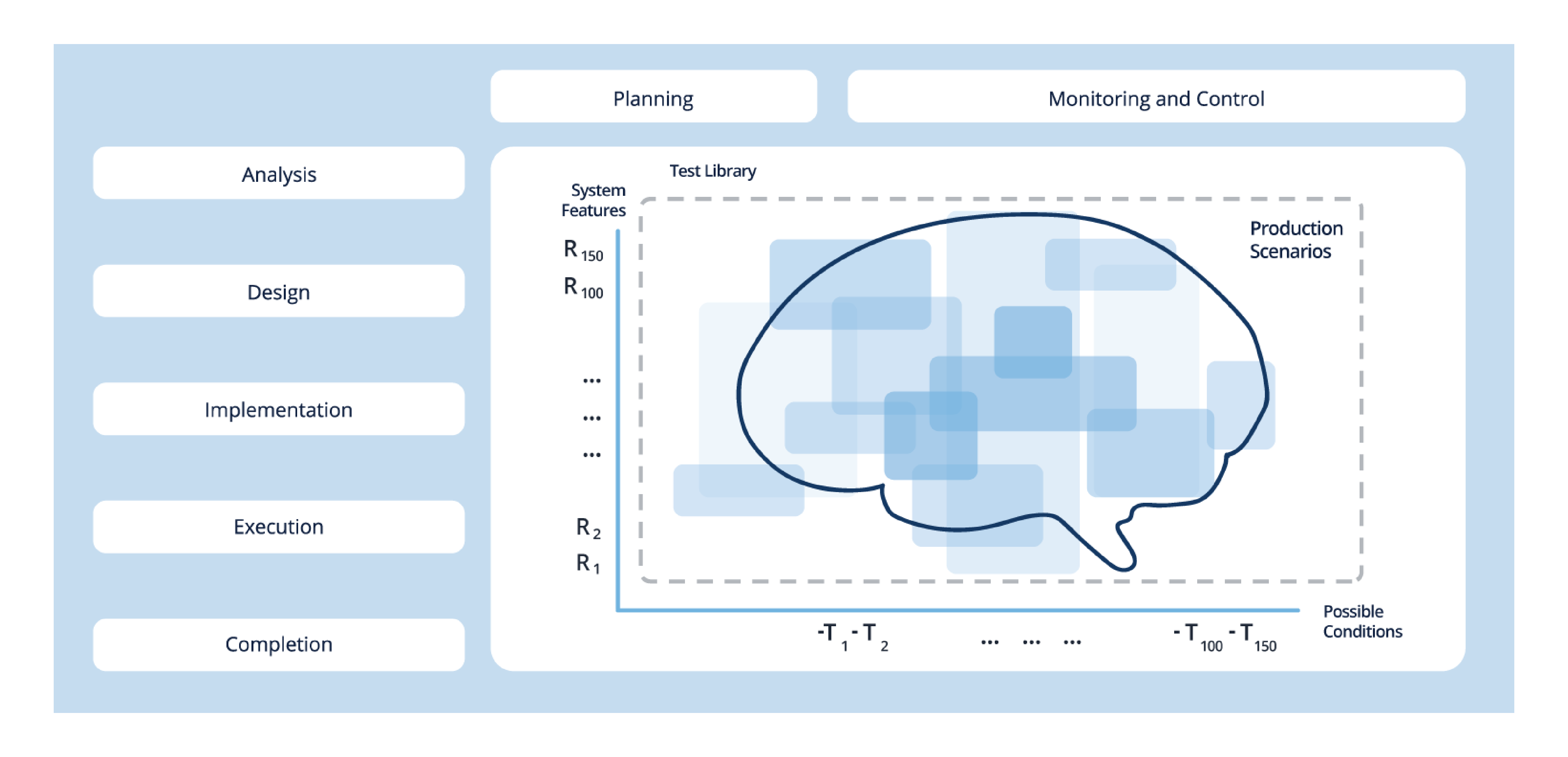

Exactpro worked in close collaboration with the MEMX team starting from the initial analysis of the test scenarios and specifications, through the test design, to the model-based and the discovery-based implementation, test planning and monitoring.

MEMX uses a modified waterfall development methodology and rapid prototyping, which resulted in frequent builds. Exactpro not only designed a detailed functional automated library covering all the required functionalities, but also worked continuously to enhance the quality and speed of the regression testing through the CI/CD process. The test coverage was analyzed by both MEMX and Exactpro teams based on problems and objectives to ensure the thoroughness of the executable test model.

Platforms: th2 Test Automation Framework for MEMX

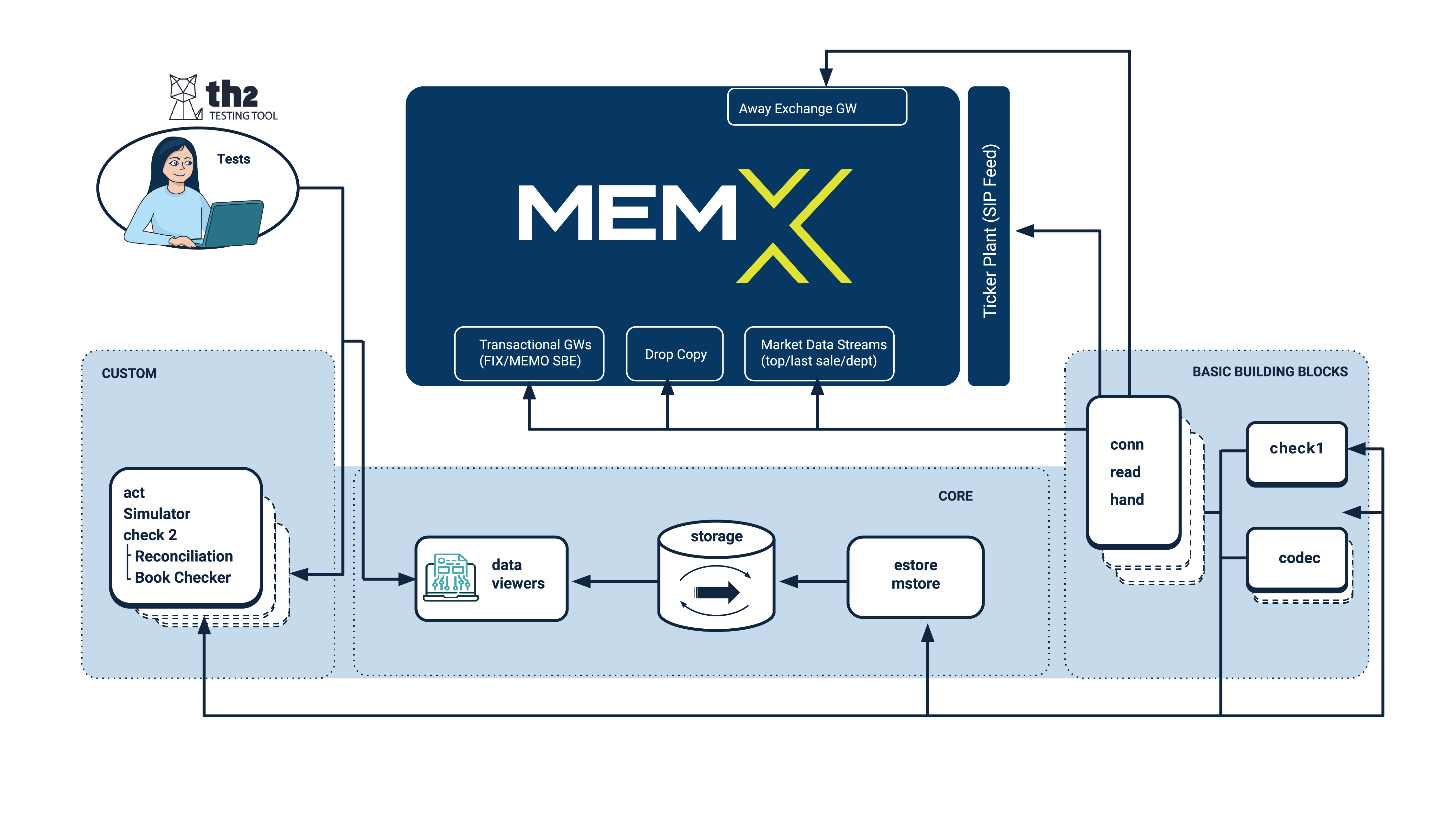

In collaboration with MEMX, Exactpro introduced its new next-generation test automation framework – th2 – into the testing process not only for active testing, but also for passive data consistency checks and reconciliation. In addition, th2 – integrated into the CI/CD testing pipeline – provided a set of stubs and drivers including the away markets simulator, which enabled deep testing of the related features.

The test platform uses a microservices-based architecture. It is cloud-native, and uses Kubernetes orchestration to schedule test containers across a cluster, scale those containers, and manage their health over time.

The th2 platform consists of 3 types of blocks:

- Core and Infrastructure Components

- Basic Building Blocks

- Custom Logic Components

The Core and Infrastructure components for th2 are available as open source software under the Apache 2.0 license. They are responsible for test component deployment, inter-service communication over Rabbit-MQ, as well as the processing and storage of messages and events in noSQL – a distributed compliance Cradle database based on Apache Cassandra.

Basic building blocks used by MEMX are of several types:

- conn components represent connections to the respective MEMX endpoints and are responsible for active communication with the system under test (SUT) in accordance with the available specifications.

- read components acquire data as passive subscribers. They are needed to apply data consistency and reconciliation checks across different data streams, irrespective of the inbound traffic. Examples of such checks include MEMO FIX/SBE transactions vs. MEMOIR last sale/drop copy, MEMOIR top vs MEMOIR depth/last sale.

- codec blocks process transactional data from conn and read components. They are responsible for encoding and decoding the messages. Multiple blocks allow support for different protocols and their versions.

- check1 contains simple verifications.

Custom logic components were configured to reflect the specifics of the MEMX platform:

- act is responsible for the active test scenario logic.

- check2 contains advanced verifications such as:

- Reconciliation which is used to widen the test coverage of the executed transactional tests by reconciling the data streams coming into and going out of the SUT.

- Book checker which builds order books based on market data output and checks the received data (both books and messages) using predefined and configurable specific rules.

- simulator was designed for the emulation of the away exchange for MEMX and was configured based on the specific business logic. The aim of the sim component is to support the designed test library of routed orders.

The platform enables the implementation, execution and analysis of a wide variety of test concepts.

People: Human Competencies for Delivering Mission Critical Systems

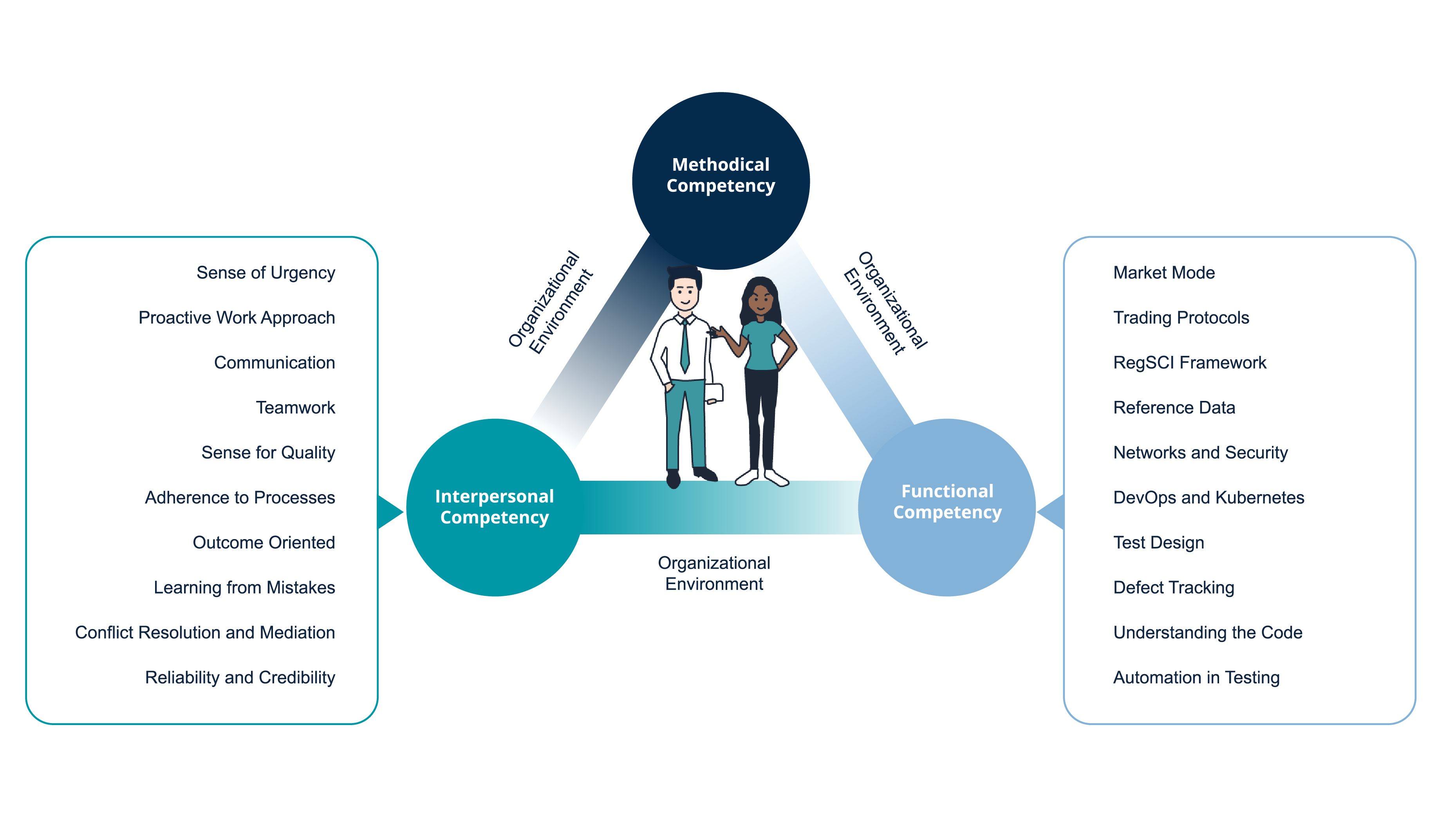

Exactpro builds software to test software to be able to verify complex systems that underpin global financial markets. To ensure the required level of services is being met, the company follows the Zero Outage Industry Standard in its human capital development strategy. The standard is a collection of best practices enabling IT professionals to plan, build, deliver and run end-to-end IT solutions suited for the most critical business functions and processes. Exactpro shares the Standard’s holistic view on going beyond technology and emphasizing that not only are platforms, processes, and security essential to IT services, but that people are the backbone of every organization and every project.

Conclusion

The extensive functional testing and test automation delivered by the Exactpro team contributed to the successful launch of the MEMX U.S. equity market in September 2020, followed by trading of all NMS symbols in October 2020.

Today, MEMX continues to be the fastest growing U.S. equities exchange. Its success is a testament to the participants’ desire for an exchange focused on fostering innovation and competition, as well as on the quality and efficiency of its platform.

Commenting on the MEMX-Exactpro collaboration, Iosif Itkin, CEO and co-founder of Exactpro, said: “Working with MEMX, the fastest-growing US equities exchange, has proved to be an invaluable experience as we continue to deploy our next-generation test automation framework, th2. With this new offering, Exactpro was able to support MEMX’s rapid deployment schedule whilst simultaneously providing the highest levels of system quality assurance.”

Thomas Toller, Managing Director, Exactpro USA, said: “We have been delighted to partner with MEMX on such an ambitious and innovative project, a natural fit for Exactpro’s services and our continued expansion into North America.”

“MEMX’s close collaboration with Exactpro provided additional operational resilience and contributed to the exchange’s seamless launch, rollout and, ultimately, live trading in all NMS symbols,” said MEMX Chief Technology Officer Dominick Paniscotti. “We greatly appreciate Exactpro’s partnership in working to ensure the exchange’s technology was ready to perform at full capacity from day one.”

About MEMX:

Founded in 2019 by diverse members of the global financial community, Members Exchange is an innovative, customer-centric market operator, focused on creating and promoting a fair, transparent, and efficient experience for all investors. MEMX offers a new option to investors, with a simpler platform and features to benefit both retail and institutional investors. For more information on MEMX, please visit www.memx.com and follow @memxtrading.

About Exactpro:

Exactpro is an independent provider of AI-enabled software testing services for financial sector organisations. Our clients are exchanges, post-trade platform operators, and banks across 20 countries. Our area of expertise comprises protocol-based testing of matching engines, market data, market surveillance, clearing and settlement systems, payments APIs. We help our clients to decrease time to market, maintain regulatory compliance, improve scalability, latency and operational resiliency. Exactpro is involved in a variety of transformation programmes related to large-scale cloud and DLT implementations at systemically important organisations.

Our approaches leverage artificial intelligence (AI) to help harness the power of exploratory data analysis and big data analytics to assist in the generation of test ideas and the interpretation of test results, supported by advanced execution capabilities of the th2 frameworks suite.

Founded in 2009, the Exactpro Group is headquartered in the UK and operates delivery centres in Georgia, Sri Lanka, Armenia, Lithuania and the UK and representative offices in the US, Canada, Italy and Australia.