Date:

Victoria Leonchik, QA Analyst for Turquoise, Exactpro

Turquoise is a unique lit and dark trading venue, offering a broad universe of over 43 hundred stocks with uniform access to 19 major European and emerging markets. Turquoise Block Discovery won the Most Innovative Trading Service in 2015. The Exactpro staff are responsible for market surveillance and the back office within Turquoise. Over the years, Exactpro has accumulated vast experience in testing the trading algorithms, constantly exploring its most interesting aspects and, as a result, truly having a lot to offer on the subject.

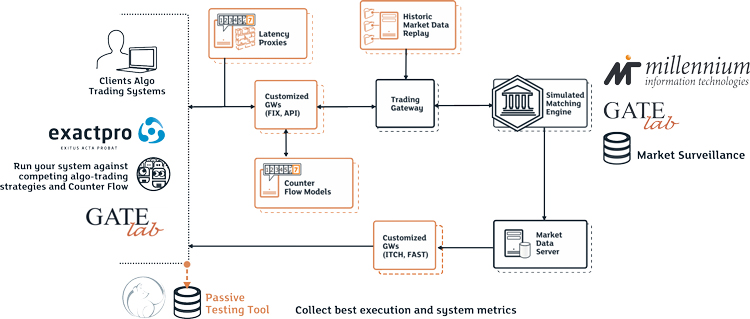

LSEG's Technology Services division incorporates MillenniumIT, GATElab, and Exactpro. Such a partnership provides access to a unique set of software from all three companies and presents a possibility to use it in order to build a test infrastructure for any system. Therefore, at Exactpro, we do not have to think how to emulate the exchange: we are the market.

With all this at our disposal, it is possible for Exactpro to deploy one or several scalable matching engines to serve as market simulators. We are able to deploy algorithmic trading tools to act as market participants, we can also replay some historic data and, at the same time, mimic a realistic market impact. In addition, our resources allow us to have latency and front-running proxies for better tests diversity.

Throughout its lifecycle, the client’s system will have to compete against a diverse universe of other algos. At Exactpro, we are even able to configure some of them to mimic malicious market manipulations. Now, it is possible to take the next version of the algo-trading system and put it to the test. However, what is the point of running it once? It is a well-known fact that markets are not deterministic, they are relentlessly unpredictable. So, ideal market simulators should be able to handle such behavior without being deterministic themselves. The testers should be able to get a slightly different result every time the tests are run.

Last but not least, passive testing capabilities may be used to capture and store all the relevant metrics (both Profit and Loss, as well as the system-related ones), all of which can be connected to the market surveillance systems.